Table of Contents

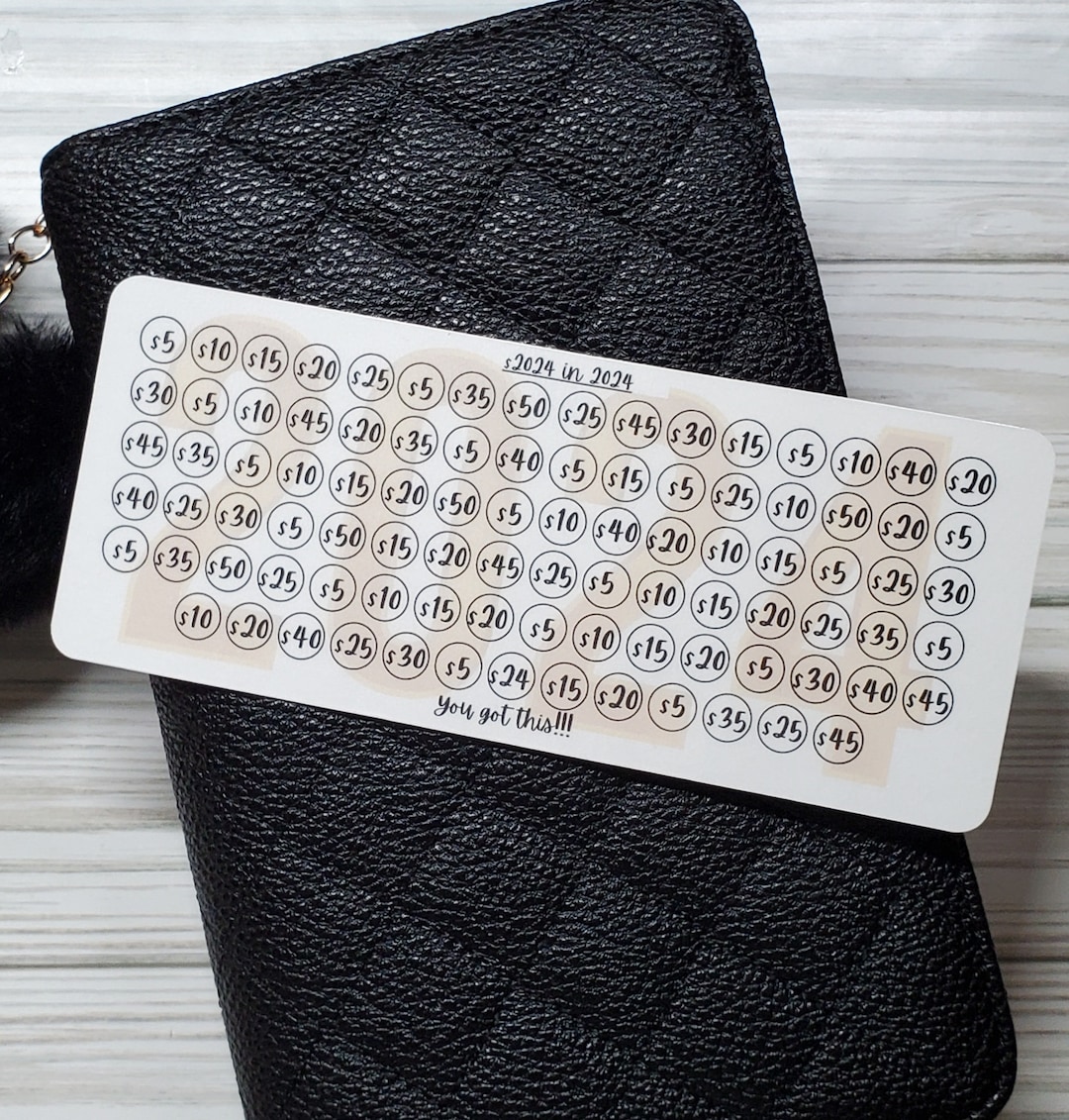

- Save 2024 in Year 2024 Saving Challenge Cash Envelope Printable Saving ...

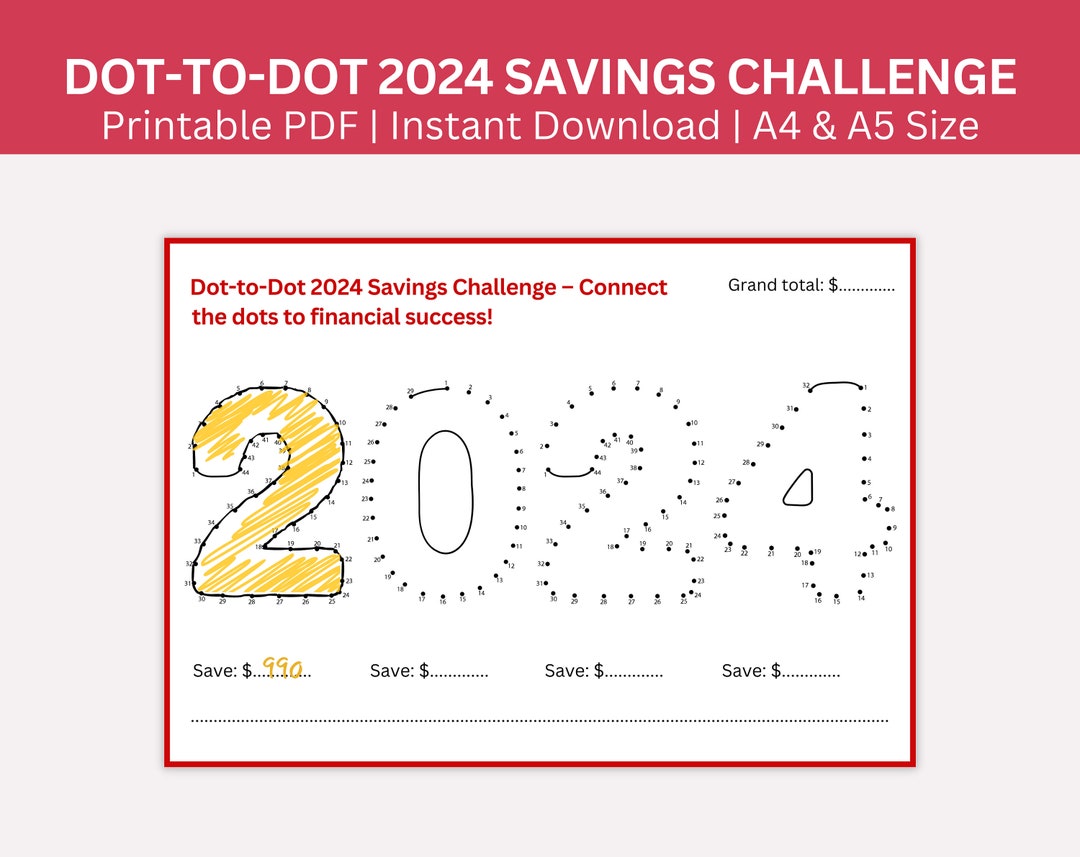

- NEW 2024 Printable Savings Challenge, Save 2024 Dollars, 2 Size Options ...

- 2024 Savings Challenge Printable, New Version A4 and A5 Size 2024 Money ...

- Money Savings 0 to 0

- Save 2024 in 2024 Savings Challenge//savings Challenge//budgeting ...

- 2024 Awards Season: What Styles To Expect Next - Trend Report - Club L ...

- Financial moves to help you save money in 2024 | FOX 32 Chicago

- 2024년 캐리 운세 무엇이든 물어 보살 |Carrie fortune for 2024, ask for anything 달려라 ...

- How To Save And Earn More Money In 2024, Take 6 Resolutions For New ...

- Tips for saving money in 2024 - Good Morning America

Assess Your Finances

Automate Your Savings

Setting up automatic transfers from your checking account to your savings or investment accounts is a great way to ensure that you save regularly. You can set up a monthly transfer or take advantage of micro-investing apps that round up your purchases and invest the change.

Cut Back on Unnecessary Expenses

Identify areas where you can cut back on unnecessary expenses, such as: Canceling subscription services you don't use Cooking at home instead of eating out Canceling gym memberships and finding free workout alternatives Shopping during sales and using coupons

Take Advantage of Digital Tools

There are many digital tools available that can help you save money, such as: Cashback apps that offer rewards on your purchases Coupon apps that help you save on groceries and household items Budgeting apps that track your expenses and provide personalized recommendations

Make Lifestyle Changes

Making lifestyle changes can also help you save money, such as: Walking or biking instead of driving Using energy-efficient appliances to reduce your utility bills Meal planning and cooking at home Avoiding credit card debt and paying off high-interest loansAdditional Tips

Here are some additional tips to help you save money in 2024: Use the envelope system to allocate cash for different expenses Take advantage of tax-advantaged retirement accounts such as 401(k) or IRA Shop during sales and clearance events Use discount codes and vouchers for online purchases Avoid impulse purchases and create a 30-day waiting period for non-essential purchases By following these 25 smart ways to save money, you can build a financial safety net and achieve your long-term goals. Remember to stay disciplined, patient, and consistent, and you'll be on your way to a more secure financial future.For more information and resources on personal finance and saving money, visit Shop Lifestyle Digital.